24/7 Unfiltrered Cripto News

Bitcoin News

Bitcoin News is the world's premier 24/7 news feed covering everything bitcoin-related, including world economy, exchange rates, industry news, regulations and money politics.

- Bitget Debuts GetClaw, a Zero-Install AI Agent Built for Instant Market Insights

This content is provided by a sponsor. Bitget, the world’s largest Universal Exchange (UEX), has unveiled GetClaw, the world’s first installation-free autonomous AI trading agent. Built on the widely adopted OpenClaw framework, GetClaw removes the technical friction that has historically separated traders from advanced AI tools. No downloads, configuration, or infrastructure management are required, with

- Babylon Labs and Ledger Partner to Expand Access to Trustless Bitcoin Vaults

Babylon Labs and Ledger have integrated native hardware signer support to provide secure, trustless bitcoin collateral solutions through a new Clear Signing partnership. Babylon Labs and Ledger announced their partnership on March 10, 2026, to bring Bitcoin Vaults (BTCVaults) to millions of self-custody users globally. This integration allows users to authorize vault transactions directly from

- Trust Wallet Introduces Real-Time Address Poisoning Protection Across 32 Blockchains

Trust Wallet has launched a new security feature that automatically detects and blocks address poisoning scams to protect users during crypto transactions. Trust Wallet announces the launch of Address Poisoning Protection on March 10, 2026, to combat the rapidly growing threat of lookalike wallet scams. The feature is currently live on mobile for 32 Ethereum

- Societe Generale-FORGE Deploys MiCA-Compliant EUR Coinvertible Stablecoin on Stellar

Societe Generale-FORGE expands its multichain strategy by launching the EUR-backed EUR Coinvertible stablecoin on the Stellar blockchain to enhance retail and business accessibility. Societe Generale-FORGE announced the deployment of its Markets in Crypto-Assets (MiCA) compliant stablecoin, EUR Coinvertible, on the Stellar network as of March 10, 2026. This launch follows previous integrations on Ethereum, Solana,

- The 20 Million Milestone: Bitcoin Mining Is, and Always Will Be, an Energy Business

Artificial intelligence is having its electricity moment. Across global markets, utilities are scrambling to connect massive new data centers. Tech giants are locking in gigawatts of power. Transmission queues to connect the new generation to the grid are backlogged. Electrical substations are suddenly strategic assets. The AI boom has made one thing clear: computation is

- Sonic Launches USSD Stablecoin With Institutional-Grade Backing

Sonic has introduced USSD, a network-native dollar stablecoin designed to serve as the primary liquidity layer across its ecosystem. Built using Frax infrastructure and backed by institutional-grade assets, the token aims to simplify cross-chain liquidity and strengthen DeFi activity on the network. USSD Stablecoin Aims to Anchor Sonic’s On-Chain Economy Sonic has unveiled USSD (US

- Stablecoin Fintech KAST Raises $80M Series A to Build Global Digital Dollar Payments Platform

Stablecoin-powered fintech platform KAST has secured $80 million in Series A funding as investors place fresh bets on digital-dollar infrastructure designed to move money across borders faster than traditional banking systems. A Bet on Stablecoins: Fintech Startup KAST Expands Global Crypto Payments Infrastructure The funding round, announced this week, was co-led by QED Investors and

- War Escalation or Hawkish Fed Pivot Could Turn Bitcoin Outlook Bearish

Rising geopolitical tensions and stubborn inflation risks could turn bearish for bitcoin, with Wintermute warning that further Middle East escalation or a hawkish Federal Reserve pivot may pressure markets already on edge. Bitcoin Steady as Oil Spike and Middle East Tensions Rattle Markets Bitcoin held modest gains during a broad market selloff as escalating tensions

- Ripple Deepens XRP Role as Core Engine of Global Payments and Liquidity Infrastructure

Ripple is pushing aggressively into global markets while embedding XRP deeper into its financial infrastructure, as CEO Brad Garlinghouse signals expanding payments, liquidity, and treasury ambitions tied to digital asset adoption. Is Ripple Quietly Building the XRP Engine That Could Reshape Global Payments Forever? Global expansion and digital asset infrastructure development were highlighted by Ripple

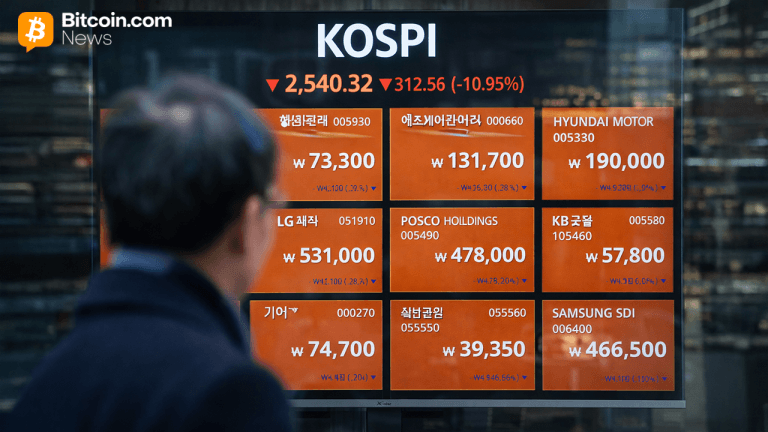

- Bitcoin Diverges From Global Prices in South Korea — Third Major Discount Since FTX

With bitcoin trading between $65,962 and $73,669 this week, market data shows South Korea posted its deepest discount to global prices since December 2024. Rare Bitcoin Discount Hits South Korea — Only Three Such Events Since 2022 Bitcoin is trading at a discount in South Korea, as metrics collected at 7 p.m. EST Tuesday show

Bitcoin News

Bitcoin News is the world's premier 24/7 news feed covering everything bitcoin-related, including world economy, exchange rates, industry news, regulations and money politics.

- Bitget Debuts GetClaw, a Zero-Install AI Agent Built for Instant Market Insights

This content is provided by a sponsor. Bitget, the world’s largest Universal Exchange (UEX), has unveiled GetClaw, the world’s first installation-free autonomous AI trading agent. Built on the widely adopted OpenClaw framework, GetClaw removes the technical friction that has historically separated traders from advanced AI tools. No downloads, configuration, or infrastructure management are required, with

- Babylon Labs and Ledger Partner to Expand Access to Trustless Bitcoin Vaults

Babylon Labs and Ledger have integrated native hardware signer support to provide secure, trustless bitcoin collateral solutions through a new Clear Signing partnership. Babylon Labs and Ledger announced their partnership on March 10, 2026, to bring Bitcoin Vaults (BTCVaults) to millions of self-custody users globally. This integration allows users to authorize vault transactions directly from

- Trust Wallet Introduces Real-Time Address Poisoning Protection Across 32 Blockchains

Trust Wallet has launched a new security feature that automatically detects and blocks address poisoning scams to protect users during crypto transactions. Trust Wallet announces the launch of Address Poisoning Protection on March 10, 2026, to combat the rapidly growing threat of lookalike wallet scams. The feature is currently live on mobile for 32 Ethereum

- Societe Generale-FORGE Deploys MiCA-Compliant EUR Coinvertible Stablecoin on Stellar

Societe Generale-FORGE expands its multichain strategy by launching the EUR-backed EUR Coinvertible stablecoin on the Stellar blockchain to enhance retail and business accessibility. Societe Generale-FORGE announced the deployment of its Markets in Crypto-Assets (MiCA) compliant stablecoin, EUR Coinvertible, on the Stellar network as of March 10, 2026. This launch follows previous integrations on Ethereum, Solana,

- The 20 Million Milestone: Bitcoin Mining Is, and Always Will Be, an Energy Business

Artificial intelligence is having its electricity moment. Across global markets, utilities are scrambling to connect massive new data centers. Tech giants are locking in gigawatts of power. Transmission queues to connect the new generation to the grid are backlogged. Electrical substations are suddenly strategic assets. The AI boom has made one thing clear: computation is

- Sonic Launches USSD Stablecoin With Institutional-Grade Backing

Sonic has introduced USSD, a network-native dollar stablecoin designed to serve as the primary liquidity layer across its ecosystem. Built using Frax infrastructure and backed by institutional-grade assets, the token aims to simplify cross-chain liquidity and strengthen DeFi activity on the network. USSD Stablecoin Aims to Anchor Sonic’s On-Chain Economy Sonic has unveiled USSD (US

- Stablecoin Fintech KAST Raises $80M Series A to Build Global Digital Dollar Payments Platform

Stablecoin-powered fintech platform KAST has secured $80 million in Series A funding as investors place fresh bets on digital-dollar infrastructure designed to move money across borders faster than traditional banking systems. A Bet on Stablecoins: Fintech Startup KAST Expands Global Crypto Payments Infrastructure The funding round, announced this week, was co-led by QED Investors and

- War Escalation or Hawkish Fed Pivot Could Turn Bitcoin Outlook Bearish

Rising geopolitical tensions and stubborn inflation risks could turn bearish for bitcoin, with Wintermute warning that further Middle East escalation or a hawkish Federal Reserve pivot may pressure markets already on edge. Bitcoin Steady as Oil Spike and Middle East Tensions Rattle Markets Bitcoin held modest gains during a broad market selloff as escalating tensions

- Ripple Deepens XRP Role as Core Engine of Global Payments and Liquidity Infrastructure

Ripple is pushing aggressively into global markets while embedding XRP deeper into its financial infrastructure, as CEO Brad Garlinghouse signals expanding payments, liquidity, and treasury ambitions tied to digital asset adoption. Is Ripple Quietly Building the XRP Engine That Could Reshape Global Payments Forever? Global expansion and digital asset infrastructure development were highlighted by Ripple

- Bitcoin Diverges From Global Prices in South Korea — Third Major Discount Since FTX

With bitcoin trading between $65,962 and $73,669 this week, market data shows South Korea posted its deepest discount to global prices since December 2024. Rare Bitcoin Discount Hits South Korea — Only Three Such Events Since 2022 Bitcoin is trading at a discount in South Korea, as metrics collected at 7 p.m. EST Tuesday show