24/7 Unfiltrered Cripto News

Bitcoin News

Bitcoin News is the world's premier 24/7 news feed covering everything bitcoin-related, including world economy, exchange rates, industry news, regulations and money politics.

- Is Your Stablecoin Actually Depegging? Here Is How to Tell

In the crypto landscape, stablecoin depegging often causes alarm, but this is frequently misinterpreted. Cain O’Sullivan of Hyperdrive explains that price drops can stem from liquidity issues rather than failures in the underlying reserves. The New Money Market ‘Meta’: Redemption over Oracles In the world of decentralized finance ( DeFi)—and the broader crypto economy—reports of

- ‘Bull Trap Forming’ – Willy Woo Says Bottom Not In for Bitcoin

Bitcoin’s bounce to the mid $70,000s had traders eyeing a bullish comeback, but one veteran on-chain analyst is urging caution, warning that the market may be flashing the kind of false-start signal that burns latecomers. Willy Woo Flags ‘Bear-Phase Regime,’ Says Any Bitcoin Rally Could Still Be a Head Fake Onchain analyst Willy Woo says

- Report: Prediction Markets Polymarket and Kalshi Eye $20B Valuations as Investor Interest Builds

According to a recent report, the two heavyweight prediction markets, Polymarket and Kalshi, are said to be chatting with prospective backers about fresh fundraising rounds. Current figures place Kalshi’s valuation near $11 billion and Polymarket’s around $9 billion, and if capital does come calling, each company is eyeing a lofty $20 billion post-money valuation. Polymarket

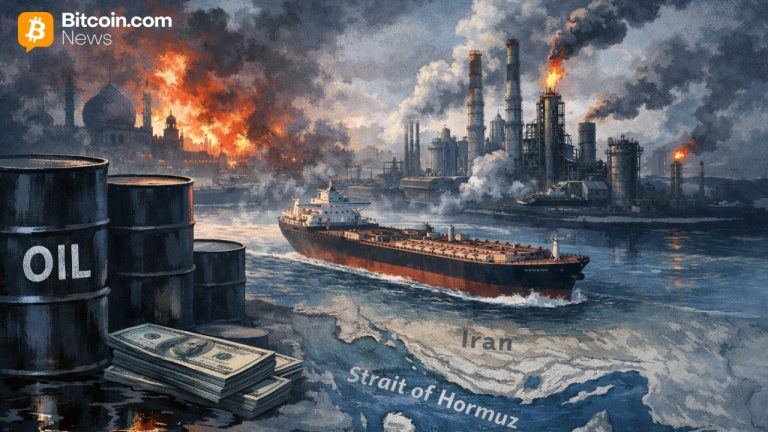

- Trump Says Oil Prices Will Drop Rapidly After Iran Nuclear Threat Destroyed

Oil markets spiked past $100 as Operation Epic Fury rattled global energy flows, with Donald J. Trump arguing the surge is a temporary price tied to eliminating Iran’s nuclear threat and restoring long-term stability. Oil Prices Spike as Trump Defends Cost of Operation Epic Fury Energy markets jolted higher as geopolitical tensions tied to “Operation

- What Happened to Tesla’s 43,770 BTC? On-Chain Data Reveals Full Story Behind Its Crypto Moves

Tesla’s $1.5 billion bitcoin bet produced early profits, huge sales during the 2022 crypto crash, and a lasting corporate crypto footprint, as blockchain analysis shows Elon Musk’s company still holds a significant stash. Arkham Traces Tesla’s $1.5B Bitcoin Bet: Early Profits, Massive 2022 Sales, and What Happened Next Tesla and its CEO Elon Musk played

- Ripple’s Coinbase Futures Access Move Signals Growing Institutional Momentum

Ripple expands institutional crypto futures access by integrating Coinbase Derivatives contracts into its prime brokerage platform, opening regulated trading opportunities for global clients and linking deeper liquidity with a rapidly growing institutional derivatives market. Regulated Crypto Futures Access Widens as Ripple Prime Links to Coinbase Access to Coinbase Derivatives futures markets widened as Ripple Prime

- US Dollar Climbs to Multi-Month Highs as Iran Conflict and Oil Spike Rattle Markets

The U.S. dollar is flexing its muscles in early March as geopolitical tensions and rising energy prices have been sending investors scrambling for what some believe is the world’s most liquid safe haven. Dollar Index Nears 100 as War Risk, Oil Prices, and Fed Policy Collide The U.S. Dollar Index (DXY), which measures the greenback

- XRP’s Billions in Dormant Liquidity Highlight Untapped Payment Potential Across XRPL

XRP is gaining renewed bullish momentum as growing attention around XRP Ledger utility and the RLUSD stablecoin fuels optimism that the network could potentially evolve into a powerful engine for everyday global payments. XRP and RLUSD May Drive Next Phase of Blockchain Payments as XRPL Focuses on Utility Momentum around real-world blockchain payments is strengthening,

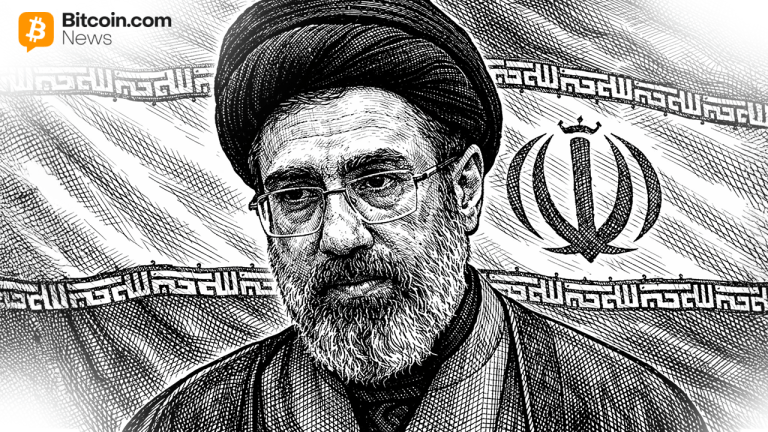

- Mojtaba Khamenei Appointed Iran’s Supreme Leader, State Media Reports

Iran’s Assembly of Experts has named Mojtaba Khamenei, the 56-year-old son of the late Supreme Leader Ayatollah Ali Khamenei, as the country’s new supreme leader, according to state media reports on Sunday. In a significant development amid the ongoing conflict with the United States and Israel, Iranian state media announced that the clerical Assembly of

- ‘The Second Century Begins’: Saylor’s Declaration Ignites Huge Bitcoin Buying Anticipation

Strategy’s massive bitcoin accumulation is back in focus after Michael Saylor shared a chart highlighting continued corporate buying, reinforcing the firm’s position as the largest public-company holder and sparking speculation that another acquisition cycle may be underway. Michael Saylor’s Bitcoin Chart Signals Ongoing Corporate Treasury Accumulation Institutional attention around corporate bitcoin accumulation resurfaced after Strategy’s

Bitcoin News

Bitcoin News is the world's premier 24/7 news feed covering everything bitcoin-related, including world economy, exchange rates, industry news, regulations and money politics.

- Is Your Stablecoin Actually Depegging? Here Is How to Tell

In the crypto landscape, stablecoin depegging often causes alarm, but this is frequently misinterpreted. Cain O’Sullivan of Hyperdrive explains that price drops can stem from liquidity issues rather than failures in the underlying reserves. The New Money Market ‘Meta’: Redemption over Oracles In the world of decentralized finance ( DeFi)—and the broader crypto economy—reports of

- ‘Bull Trap Forming’ – Willy Woo Says Bottom Not In for Bitcoin

Bitcoin’s bounce to the mid $70,000s had traders eyeing a bullish comeback, but one veteran on-chain analyst is urging caution, warning that the market may be flashing the kind of false-start signal that burns latecomers. Willy Woo Flags ‘Bear-Phase Regime,’ Says Any Bitcoin Rally Could Still Be a Head Fake Onchain analyst Willy Woo says

- Report: Prediction Markets Polymarket and Kalshi Eye $20B Valuations as Investor Interest Builds

According to a recent report, the two heavyweight prediction markets, Polymarket and Kalshi, are said to be chatting with prospective backers about fresh fundraising rounds. Current figures place Kalshi’s valuation near $11 billion and Polymarket’s around $9 billion, and if capital does come calling, each company is eyeing a lofty $20 billion post-money valuation. Polymarket

- Trump Says Oil Prices Will Drop Rapidly After Iran Nuclear Threat Destroyed

Oil markets spiked past $100 as Operation Epic Fury rattled global energy flows, with Donald J. Trump arguing the surge is a temporary price tied to eliminating Iran’s nuclear threat and restoring long-term stability. Oil Prices Spike as Trump Defends Cost of Operation Epic Fury Energy markets jolted higher as geopolitical tensions tied to “Operation

- What Happened to Tesla’s 43,770 BTC? On-Chain Data Reveals Full Story Behind Its Crypto Moves

Tesla’s $1.5 billion bitcoin bet produced early profits, huge sales during the 2022 crypto crash, and a lasting corporate crypto footprint, as blockchain analysis shows Elon Musk’s company still holds a significant stash. Arkham Traces Tesla’s $1.5B Bitcoin Bet: Early Profits, Massive 2022 Sales, and What Happened Next Tesla and its CEO Elon Musk played

- Ripple’s Coinbase Futures Access Move Signals Growing Institutional Momentum

Ripple expands institutional crypto futures access by integrating Coinbase Derivatives contracts into its prime brokerage platform, opening regulated trading opportunities for global clients and linking deeper liquidity with a rapidly growing institutional derivatives market. Regulated Crypto Futures Access Widens as Ripple Prime Links to Coinbase Access to Coinbase Derivatives futures markets widened as Ripple Prime

- US Dollar Climbs to Multi-Month Highs as Iran Conflict and Oil Spike Rattle Markets

The U.S. dollar is flexing its muscles in early March as geopolitical tensions and rising energy prices have been sending investors scrambling for what some believe is the world’s most liquid safe haven. Dollar Index Nears 100 as War Risk, Oil Prices, and Fed Policy Collide The U.S. Dollar Index (DXY), which measures the greenback

- XRP’s Billions in Dormant Liquidity Highlight Untapped Payment Potential Across XRPL

XRP is gaining renewed bullish momentum as growing attention around XRP Ledger utility and the RLUSD stablecoin fuels optimism that the network could potentially evolve into a powerful engine for everyday global payments. XRP and RLUSD May Drive Next Phase of Blockchain Payments as XRPL Focuses on Utility Momentum around real-world blockchain payments is strengthening,

- Mojtaba Khamenei Appointed Iran’s Supreme Leader, State Media Reports

Iran’s Assembly of Experts has named Mojtaba Khamenei, the 56-year-old son of the late Supreme Leader Ayatollah Ali Khamenei, as the country’s new supreme leader, according to state media reports on Sunday. In a significant development amid the ongoing conflict with the United States and Israel, Iranian state media announced that the clerical Assembly of

- ‘The Second Century Begins’: Saylor’s Declaration Ignites Huge Bitcoin Buying Anticipation

Strategy’s massive bitcoin accumulation is back in focus after Michael Saylor shared a chart highlighting continued corporate buying, reinforcing the firm’s position as the largest public-company holder and sparking speculation that another acquisition cycle may be underway. Michael Saylor’s Bitcoin Chart Signals Ongoing Corporate Treasury Accumulation Institutional attention around corporate bitcoin accumulation resurfaced after Strategy’s